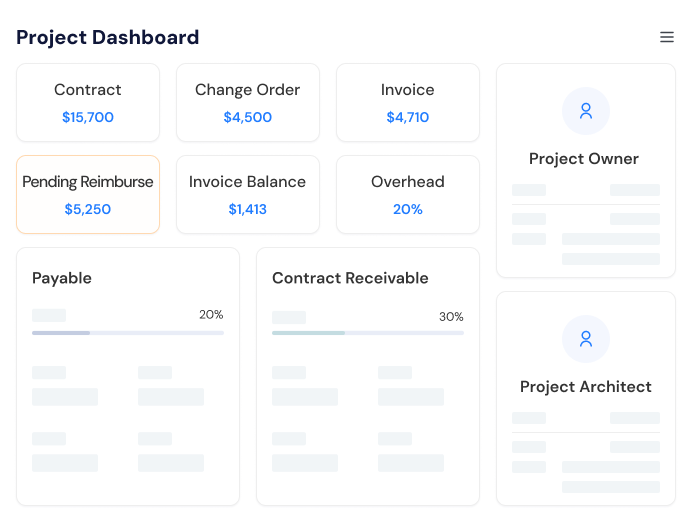

Third Parties Payment

Track Jobsite Purchases by Individuals

When workers, superintendents, or employees pay out of pocket for jobsite materials, you need a reliable way to track those expenses. APARBooks lets you record these third-party payments clearly and accurately, and every reimbursement is backed by a complete, organized history.

Easily Record Payments

Log payments made by others on behalf of the GC, ensuring accurate transaction tracking.

Maintain Accurate Records

Track third-party payments to maintain complete and accurate financial records.

Clear Money Flow

Track the flow of money for each project and ensure all payments are recorded properly.

Track Every Payment

Get full visibility of every payment made on behalf of the GC, ensuring accuracy.

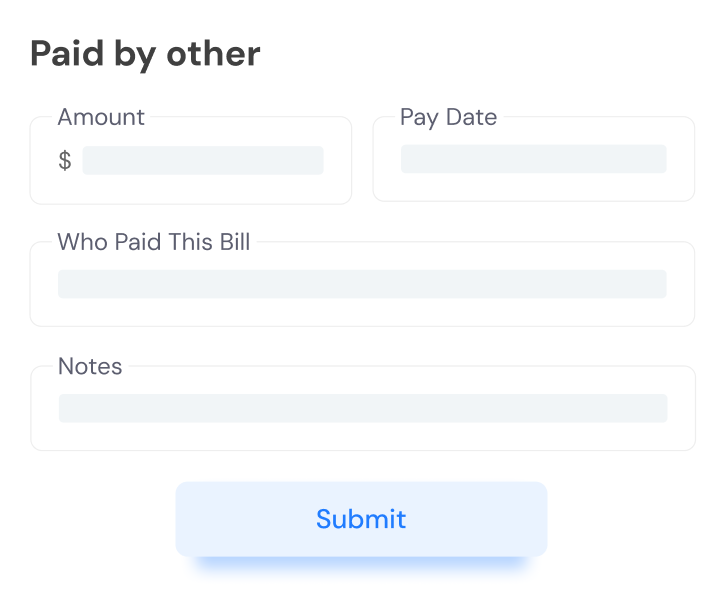

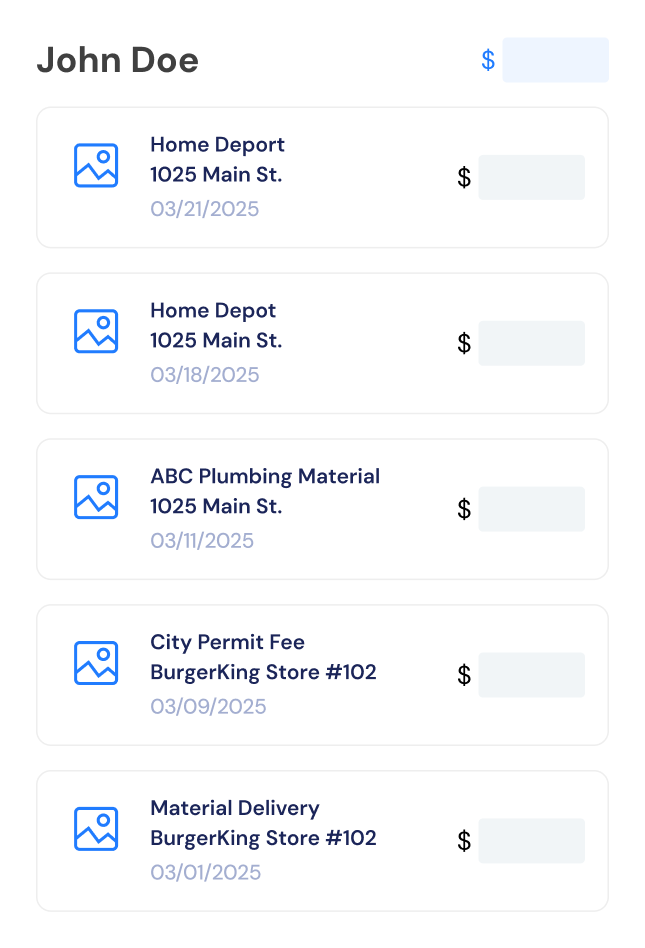

Third Party Payment Entry

In construction, it's common for workers, superintendents, or other individuals to purchase materials using personal funds. With APARBooks, you can easily log and track these third party payments, keeping all records accurate and audit ready. Every out-of-pocket purchase made on behalf of the project is recorded with clear details, ensuring full transparency and accountability across your job costing.

This feature simplifies your bookkeeping by organizing these external payments in one place, keeping them separate from vendor bills.

- Accurate tracking

- Transparent transactions

- Clear records

- Simplified bookkeeping

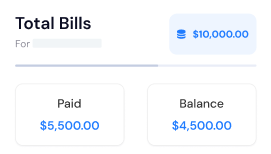

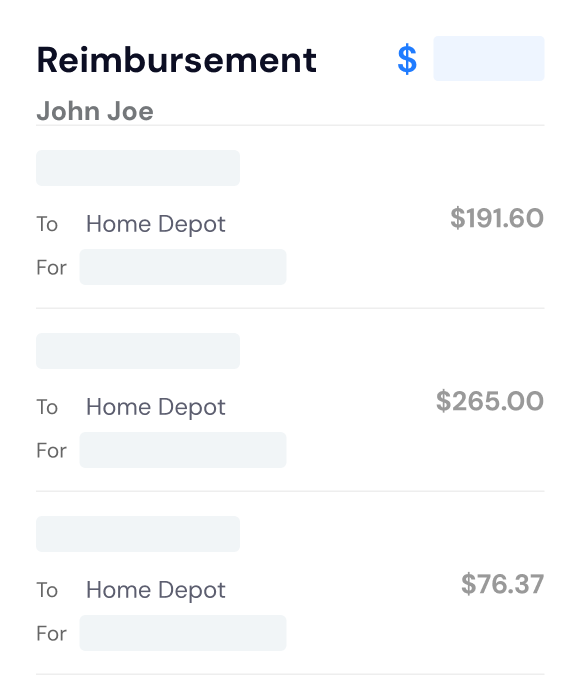

Tracking Reimbursement

APARBooks makes it easy to manage reimbursements for out-of-pocket material purchases made by employees, foremen, or other third parties.

This feature eliminates confusion by organizing all reimbursable transactions in one place, complete with receipts, dates, and payer details. You'll know exactly who paid for what, how much is owed, and when reimbursement is due. APARBooks ensures that repayment amounts are accurate, timely, and fully documented.

- Link expenses

- Track reimbursements

- Clear documentation

- Streamlined process

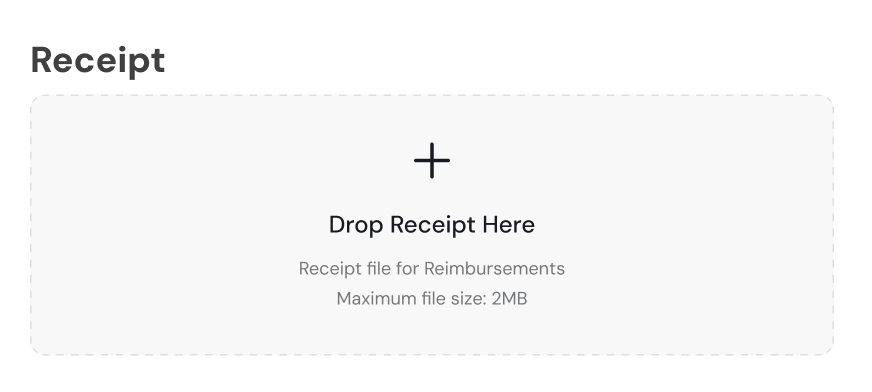

Audit-Ready Records

When it comes to third party material purchases, clean documentation is critical, especially during audits. APARBooks ensures every payment made outside the company is properly recorded and easily accessible. Each entry captures key details, including the payer's name, payment date, amount, project association, and attached proof such as receipts or invoices.

This centralized recordkeeping not only keeps your financials organized but also protects your business from discrepancies, missing reimbursements, and compliance issues.

- Clear history

- Comprehensive records

- Audit-ready

- Risk reduction

Third Party Payments to Subs

In construction projects, it's not uncommon for subcontractors to receive payments directly from third parties, such as project owners or developers. With APARBooks, these payments are automatically reflected in the subcontractor's ledger, ensuring your accounting stays accurate.

This feature helps bookkeepers maintain a clear and up-to-date record of subcontractor balances. Whether it's a partial payment, full invoice amount, or an advance from an external party, APARBooks adjusts the subcontractor's ledger accordingly.

- Automatic ledger updates

- Simplified payment tracking

- Up-to-date subcontractor records

- Accurate financial tracking

Frequently Asked Questions

Feel free to contact us if you have any other questions. Reach us at support@aparbooks.com

A third-party payment refers to any payment made on behalf of the construction company by someone. This often includes employees, superintendents, or field workers who use their own funds to purchase materials or services for a project.

With APARBooks, you can easily record any material purchase made by an individual outside the company. Simply enter the payment details, such as payer name, amount, date, and project, then attach the receipt or invoice.

APARBooks simplifies reimbursement by allowing you to link each third-party payment directly to its related project and expense category. This creates a clear record of who paid, what was purchased, and how much is owed.

Yes. APARBooks lets you connect each out-of-pocket payment to a specific reimbursement record, ensuring full traceability. This matching process keeps your books aligned, helps you avoid errors, and provides a seamless way to approve, apply, and close out reimbursements in your workflow.

Absolutely. APARBooks offers flexible filters that let you view third-party payments by project, payment date, payer name, or even reimbursement status.

Yes. APARBooks allows you to export detailed reports of all third-party payments made across your projects. Each report includes key information like payer name, date, amount, associated project, and attached documentation such as receipts or invoices.

In the meantime

We provide bookkeeping service

We handle all aspects of your bookkeepings, so you can focus on growing your business.

Request a Demo