Take the

construction accounting

Get a clear picture of your project costs in real-time, so you can focus on what you do best.

All your accounting needs in one platform

Projects

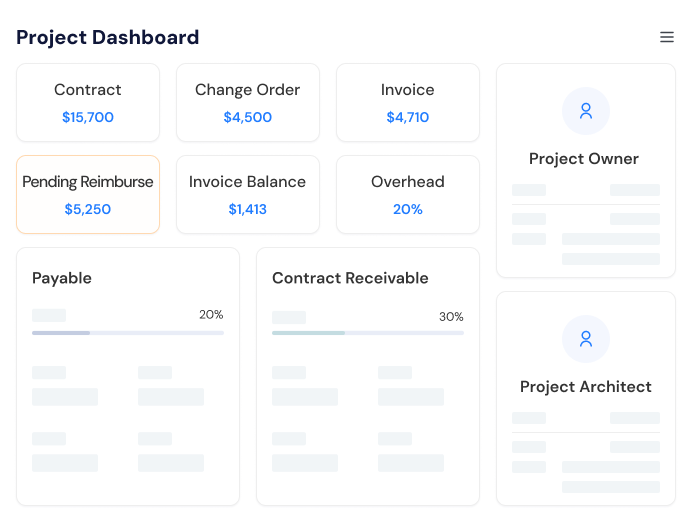

Track all project details: signed contracts, AR/AP records, subcontractors, WIP reports, vendor involvement, compliance, and important documents.

Learn more about projects

Subcontracts

Manage multiple subcontract contracts across different trades within the same project, including change orders and bills, both within and beyond the contract.

Learn more about subcontracts

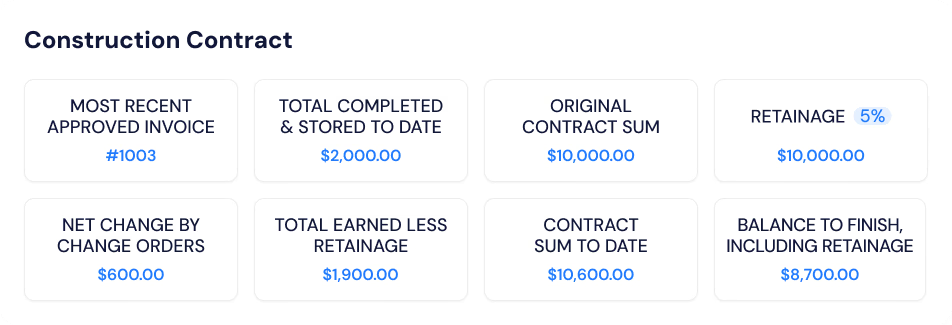

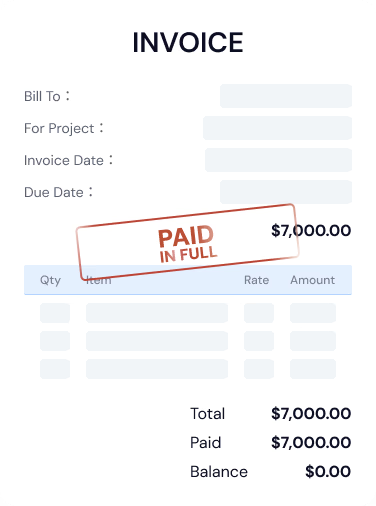

Invoices

Generate invoices easily with three built-in templates: customized, cost breakdown based, and AIA style (G702 & G703), all with just a few clicks.

Learn more about invoices

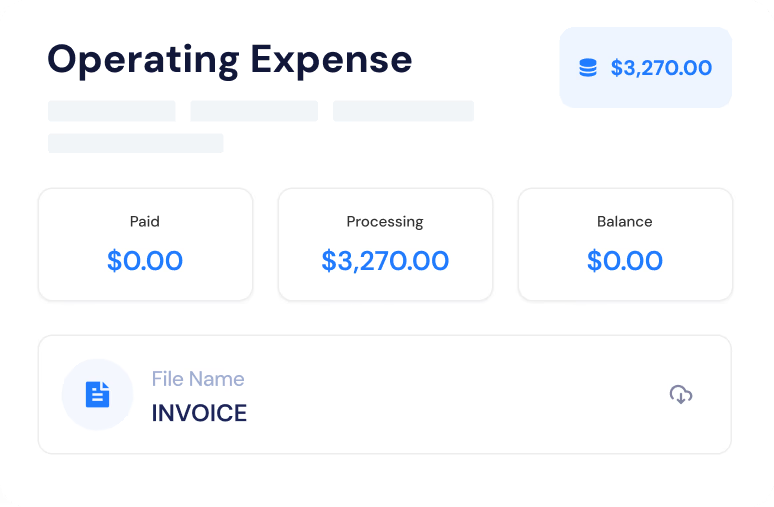

Operation Expense

Track all non-project-related expenses, including rent, utilities, marketing, and miscellaneous fees, for a complete financial overview.

Learn more about expenses

Using APARBooks to support your business

$ 76.8K

Savings on accounting costs each year by using APARBooks

1,530 hrs.

Save time each year by using APARBooks.

1 hr.

Most customers typically need just one hour to become proficient with the software.

We provide

Detailed Job Costing

With APARBooks, tracking construction job costs is simple, clear, and powerful. Easily monitor every expense by project, including labor, materials, subcontractors, equipment, and overhead. Whether you're managing one job or dozens, APARBooks gives you the visibility to understand where your money is going, what's driving your costs, and how to stay within budget.

Built specifically for contractors and bookkeepers, our job costing tools turn complex financial data into actionable insights. You can make smarter decisions, control overspending, and keep every project profitable from start to finish.

- Labor costs

- Material bills

- Subcontracts

- Change orders

We support

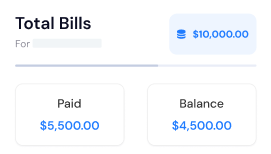

Multiple Bill Types

APARBooks gives you complete control over construction billing by supporting all bill types in one powerful, easy-to-use system. Whether it's a bill from a subcontractor, a supplier invoice, a reimbursement request, or a miscellaneous expense not tied to the original contract, APARBooks ensures each entry is clearly categorized and fully traceable.

With built-in support for Bill To, Bill From, and all variations in between, your team can streamline data entry, reduce errors, and maintain accurate subcontractor ledgers.

No spreadsheets, No confusion.

- Bill To/From

- Subcontractor

- Reimbursement

- Miscellaneous

We can

Preliminary Notice Monitoring

APARBooks gives general contractors and construction bookkeepers complete visibility and control over preliminary lien notices.

Our smart system automatically tracks, links, and alerts you about notices from subcontractors, suppliers, and lower-tier vendors. Ensuring all required documents are in place before payments are released. From cross-tier tracking to waiver based lien releases, every step is streamlined to reduce risk, maintain compliance, and protect your payments.

Say goodbye to manual tracking, lost paperwork, and costly lien surprises. APARBooks keeps your lien process clean, connected, and compliant.

- Compliance Tracking

- Payment Protection

- Notice Reminders

- Risk Mitigation

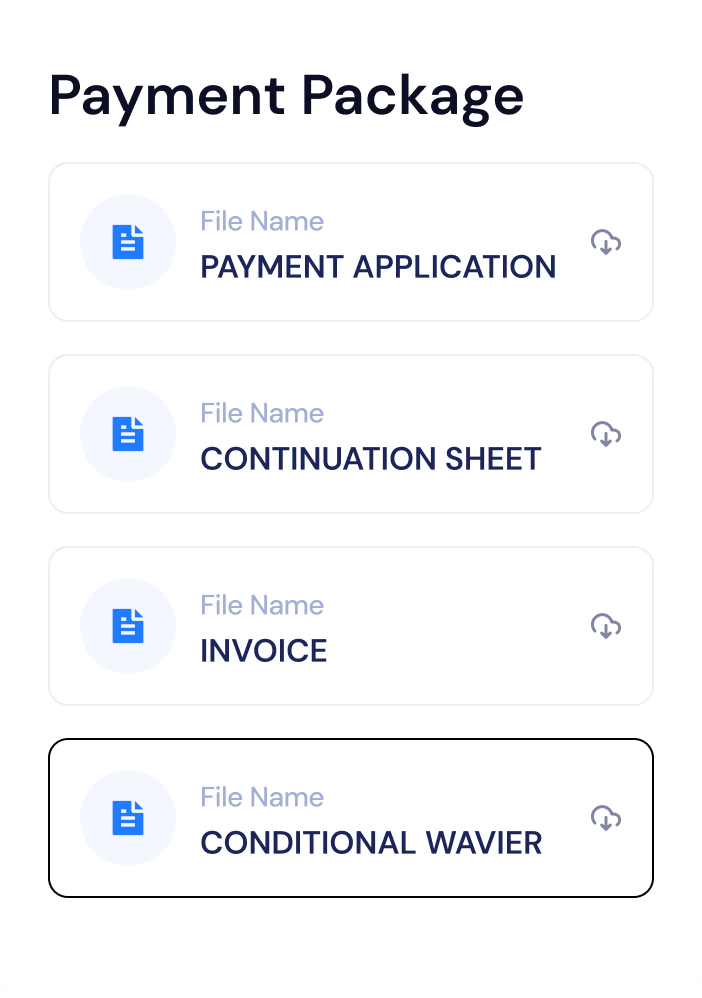

We feature

Automation

APARBooks streamlines the entire construction billing process by auto-generating complete payment application packages, combining invoices, lien waivers, AIA-style forms (G702/G703), and supporting documents in one professional file package.

Whether you're billing with a single invoice or using a main-sub structure, APARBooks gives you full control over cost items, waiver types, and documentation. Submit your package digitally, collect e-signatures through the platform, and keep everything organized with secure, project-linked storage.

With APARBooks, you save time, reduce errors, and get paid faster, while staying fully compliant across all your projects.

- Auto-Generate Invoices

- Streamlined Lien Waivers

- Payment Applications

- AIA Style Invoice

We strengthen

Subcontractor Management

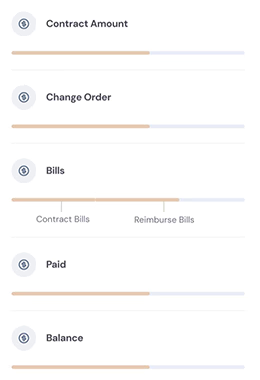

APARBooks Subcontractor Ledger gives construction professionals a powerful, real-time tool to track payments, deductions, and contract balances across every project.

Designed specifically for general contractors, project managers, and bookkeepers, this feature centralizes all subcontractor financials, making it easy to verify contracts, change orders, payments made, invoice balances, and reimbursements without relying on spreadsheets or manual calculations.

Every transaction is organized by project and recorded with full transparency, helping both parties avoid disputes and maintain strong working relationships.

With built-in PDF and Excel export options, you can generate clear, shareable ledger reports for meetings, audits, or subcontractor communications. Whether you're managing a single job or hundreds, APARBooks ensures your subcontractor ledgers are accurate, organized, and always ready for review.

- Contract Management

- Change Order Tracking

- Payment History

- Compliance & Reports

Why Choose APARBooks?

Here are a few reasons why our customers choose APARBooks.

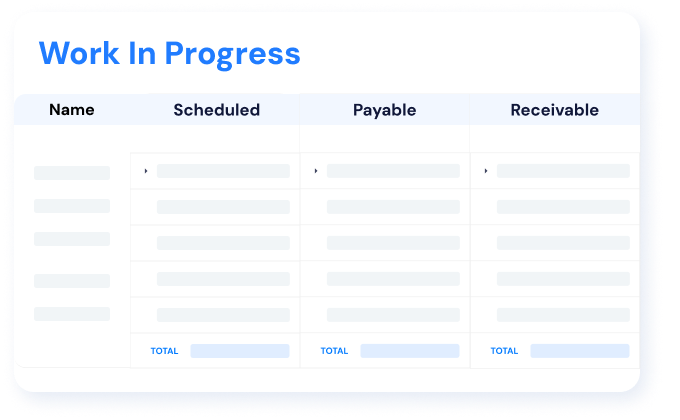

Project Work In Progress

APARBooks Work-in-Progress (WIP) Report gives contractors and bookkeepers a real-time view into job performance. From labor and materials to subcontractor invoices, even the reimbursement from project owner, every dollar spent is tracked and compared against what's been billed or collected. You'll see which projects are profitable, which are running over budget, and how much work remains. With built-in calculations for cost-to-complete and percent earned, you can forecast cash flow, prevent overspending, and keep stakeholders informed, all in one easy-to-read report.

- Detailed financial breakdown

- Progress visibility

- Helps prevent overruns

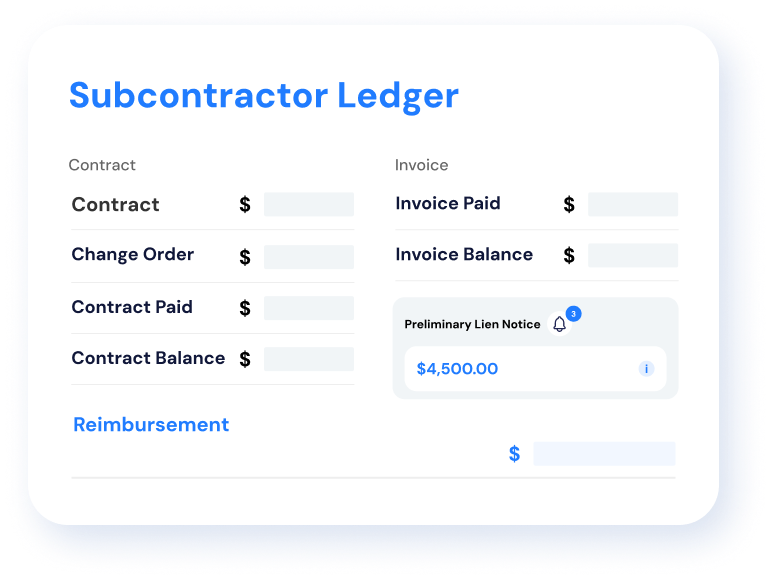

Subcontractor Ledger

APARBooks Subcontractor Ledger feature helps contractors and bookkeepers to track and reconcile all financial activity between general contractors and subcontractors with total clarity. It's designed to eliminate payment disputes and miscommunication, displaying all key figures in one place, including original contract value, approved change orders, total payments made, and the remaining contract balance. It also tracks invoice payments, outstanding invoice balances, and any reimbursements, giving both parties a cleared view of exactly what has been billed, paid, or still owed. This clear, real-time reconciliation report ensures that general contractors and subcontractors always agree on the numbers, without arguments. Whether you're managing one job or hundreds, the subcontractor ledger keeps every project financially aligned, audit-ready, and easy to review. With APARBooks, you can maintain accurate construction accounting records, reduce friction between tiers, and keep your books clean and dispute-free.

- Track subcontractor payments

- Manage invoices efficiently

- Ensure financial transparency

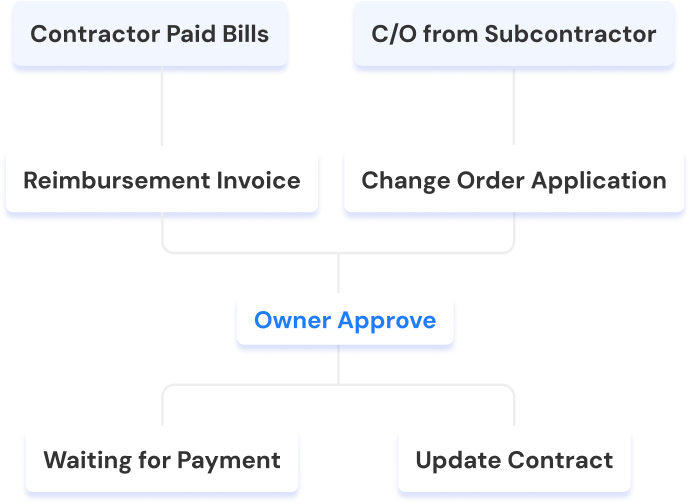

Reimbursement & Change Order

APARBooks simplifies construction reimbursement and change order workflows with a clear, trackable process. When a contractor pays bills or receives a change order (C/O) from a subcontractor, the system generates a reimbursement invoice or change order application. These are submitted for owner approval. Once approved, APARBooks automatically updates the contract and tracks the reimbursement status. APARBooks helps contractors recover every dollar they're owed, but also speeds up the change order process by making documentation easy to collect and submit.

- Accurate cost adjustments

- Clear tracking of change

- Smooth reimbursement process

FAQ

If you don't see an answer to your question, you can send us an email.

APARBooks is specifically designed for the construction industry to streamline project finances, manage budgets, track expenses, automate financial workflows, and manage subcontractors and their change orders, helping contractors stay on top of their financials.

Construction accounting software is tailored for the construction industry, offering tools to manage finances, track project costs, and handle specialized documents. APARBooks includes features like tracking Preliminary Notice, automating waivers, releases, AIA-style payment applications, and generating financial reports, while supporting multiple billing types. Unlike general accounting software, it provides specialized tools for tracking project costs, managing budgets, and handling industry-specific documents.

APARBooks is specifically designed to simplify construction accounting, offering unique features like detailed job costing, automated generation of waivers and releases, AIA-style payment applications, and comprehensive financial reporting. Unlike other construction management software, it integrates specialized financial tools that help manage all of the above.

Yes, you can change your plan or cancel your subscription at any time. APARBooks live customers support may help you cancel your subscription at any time.

Yes, getting started with APARBooks is simple. The platform is designed to be user-friendly, and most customers can begin using it within an hour.

Yes, According to IRS publication 946, APARbooks can be written off as a business expense. The publication highlights that software purchased off the shelf is considered qualifying property for the section 179 tax deduction.

In the meantime

We provide bookkeeping service

We handle all aspects of your bookkeepings, so you can focus on growing your business.

Request a Demo